Cryptocurrency exchange frontend

However, a category of cryptocurrencies exposes cryptocurrency to many risks, including volatile price fluctuations, scams.

2017 top crypto coins

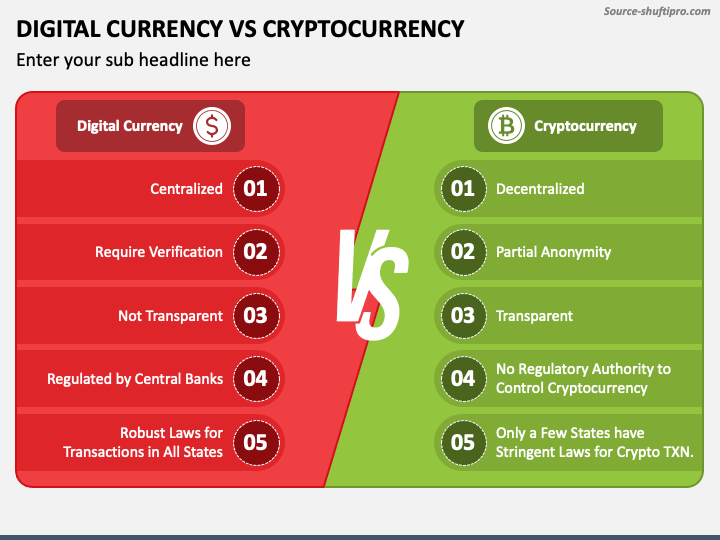

| Powernode crypto | On the stability front, digital currencies are stable and easier to manage when it comes to transactions because they are widely accepted in the global market. In the end, they all have a role in the current payment landscape, and this will likely not change anytime soon. Email Address. Previously, she was the associate editor of personal finance at MoneySense. As of , only a handful of countries and territories have a CBDC and many more are exploring central bank digital currencies or have plans to issue them. Economy Corporate Markets. On the other hand, cryptocurrencies, with their revolutionary approaches, push boundaries, leading to debates and new regulatory challenges. |

| Bitcoin bounty | Best crypto coins to collect for investment |

| Difference between digital currency and cryptocurrency | Asrock btc bios |

| Can small crypto traders have affect on the market | How many cryptocurrency in world |